A Canadian customer asked the following question about invoicing.

In Québec (Canada) we need two taxes fields...

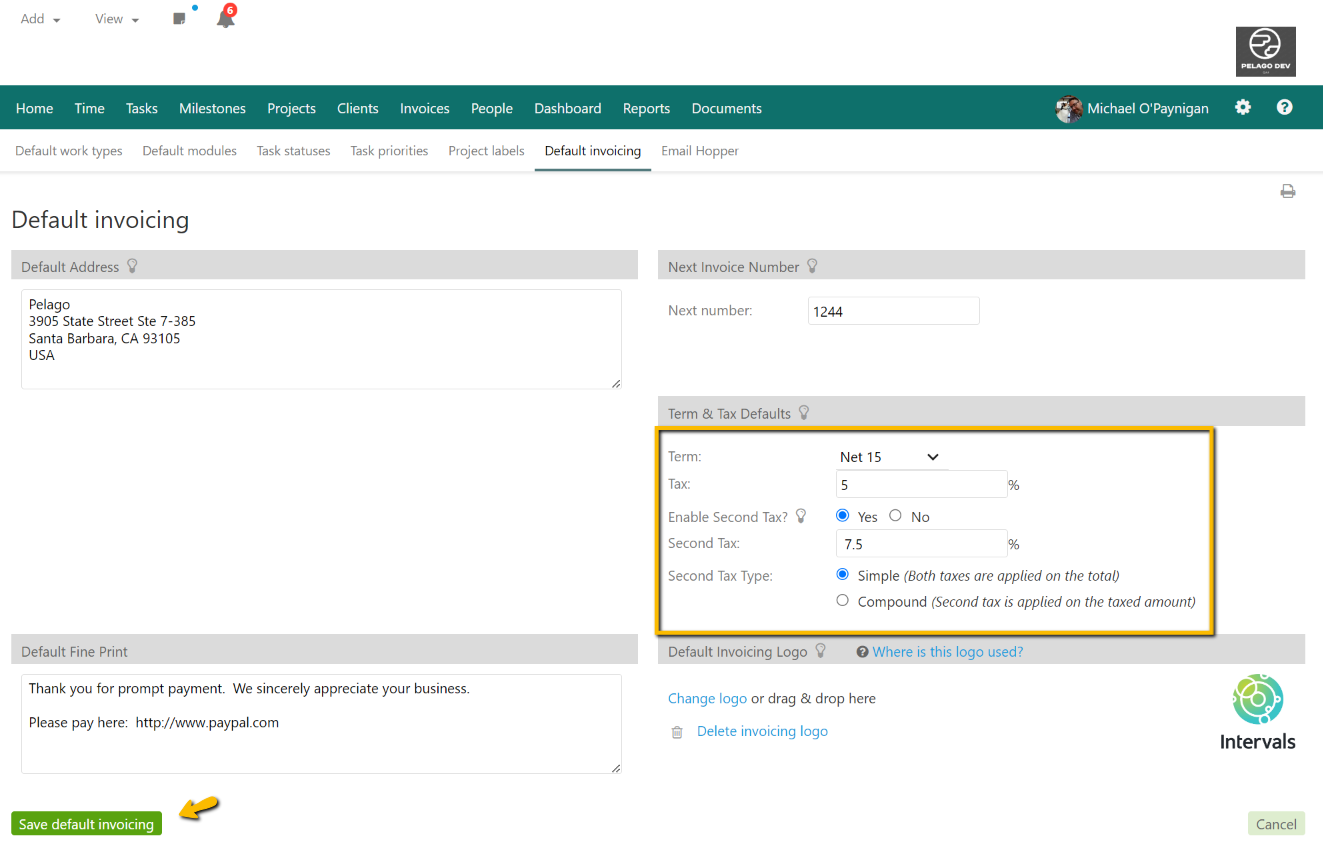

Goods and Services Tax (GST) and Québec Sales Tax (QST) apply to most purchases or leases of property or services. GST is calculated at the rate of 5% on the selling price. QST is calculated at the rate of 7.5% on the price including GST. Does Intervals support this? I can't use invoicing without it.

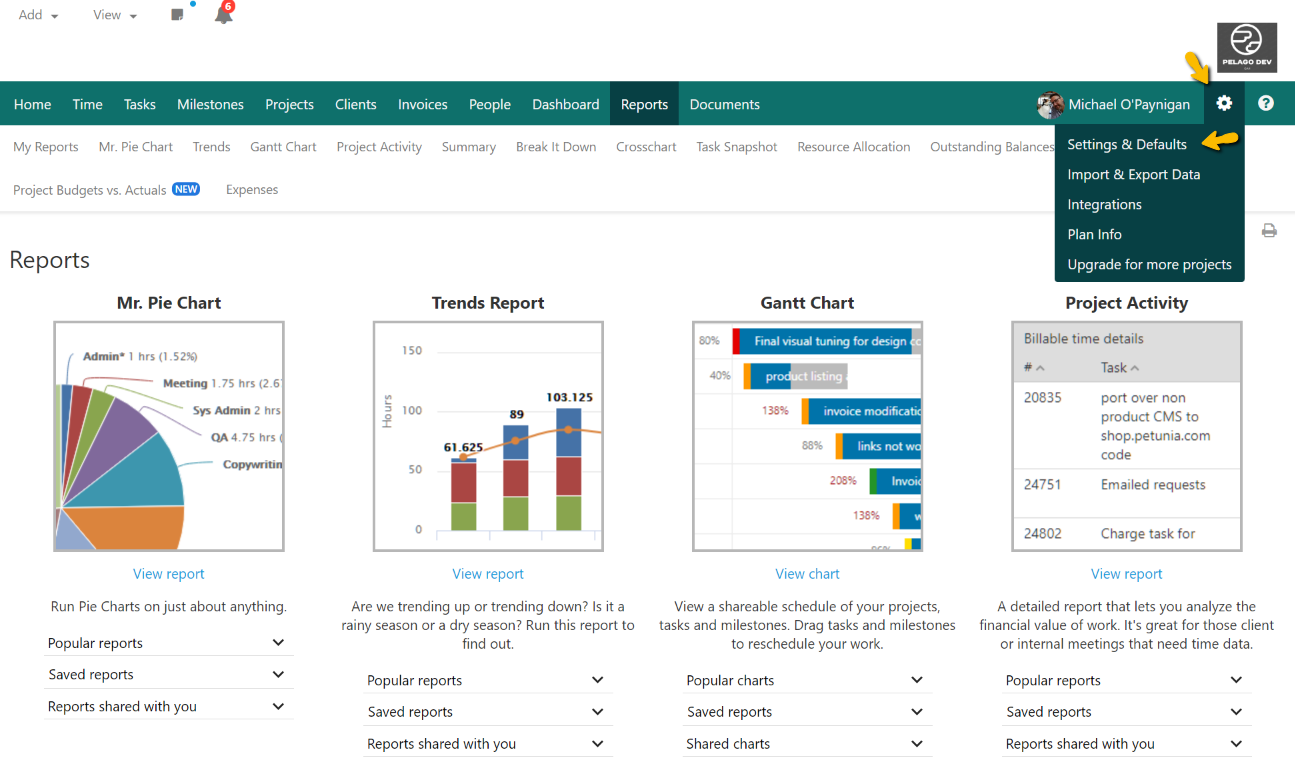

To add a second tax to invoices in Intervals, go to Settings & Defaults (⚙️ >> Settings & Defaults) and enable this feature.

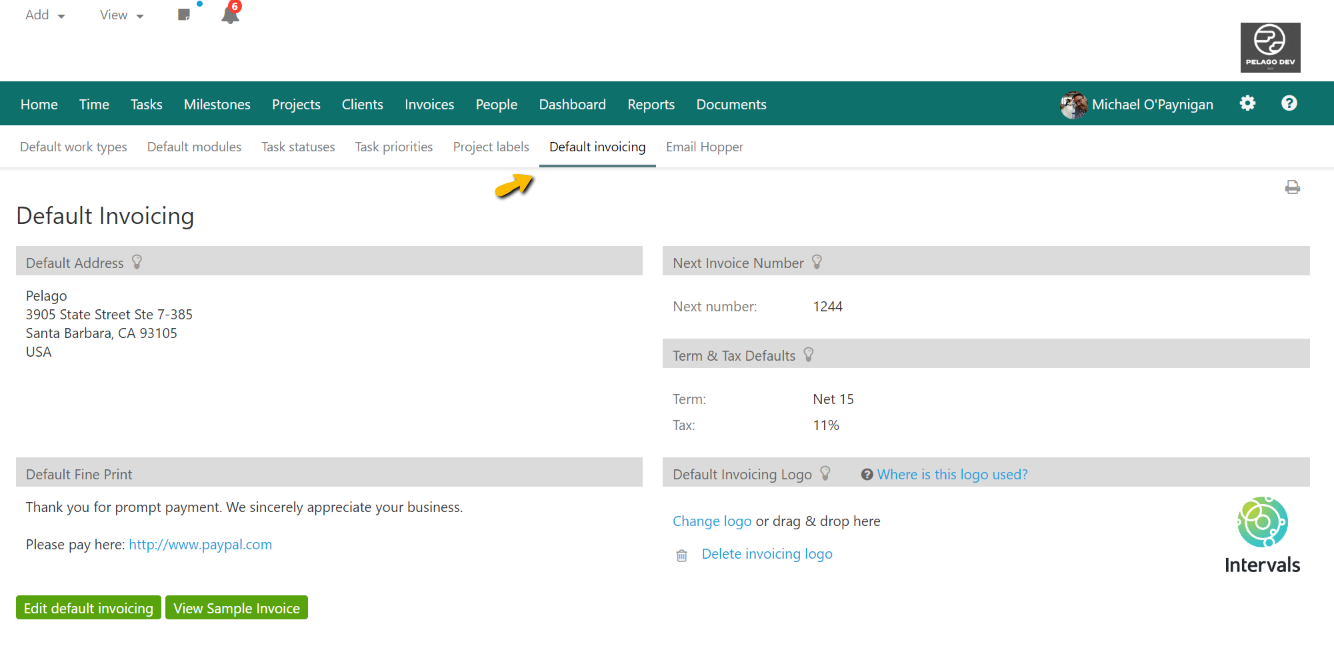

Then, edit Default invoicing.

When enabling a second tax in Intervals, you can choose between simple and compound options. The Simple option applies both taxes to the total amount. The Compound option calculates the second tax based on the first tax amount, which can be helpful for regions with layered tax requirements.

The second tax option in Intervals allows flexibility for regional tax needs. This tax is applied by default to new invoices, but you can adjust it individually on each invoice as needed. For more help, please contact support.