Intervals features the ability to build an invoice from your company’s timesheets. It works by pulling in all of the billable time entries that match the project and date range you provide. Because invoices are used for client billing, the default behavior is to not include unbillable time on the invoice.

However, we’ve had customers ask how they can include unbillable time on an invoice. There are several reasons why this may be necessary. For example, one customer we spoke to charges their clients a monthly retainer. They wanted to include an accounting of the hours they spent over the agreed upon amount. Another customer simply wanted to include unbillable time they spent correcting a mistake they had made.

There are two ways to include unbillable time with an invoice.

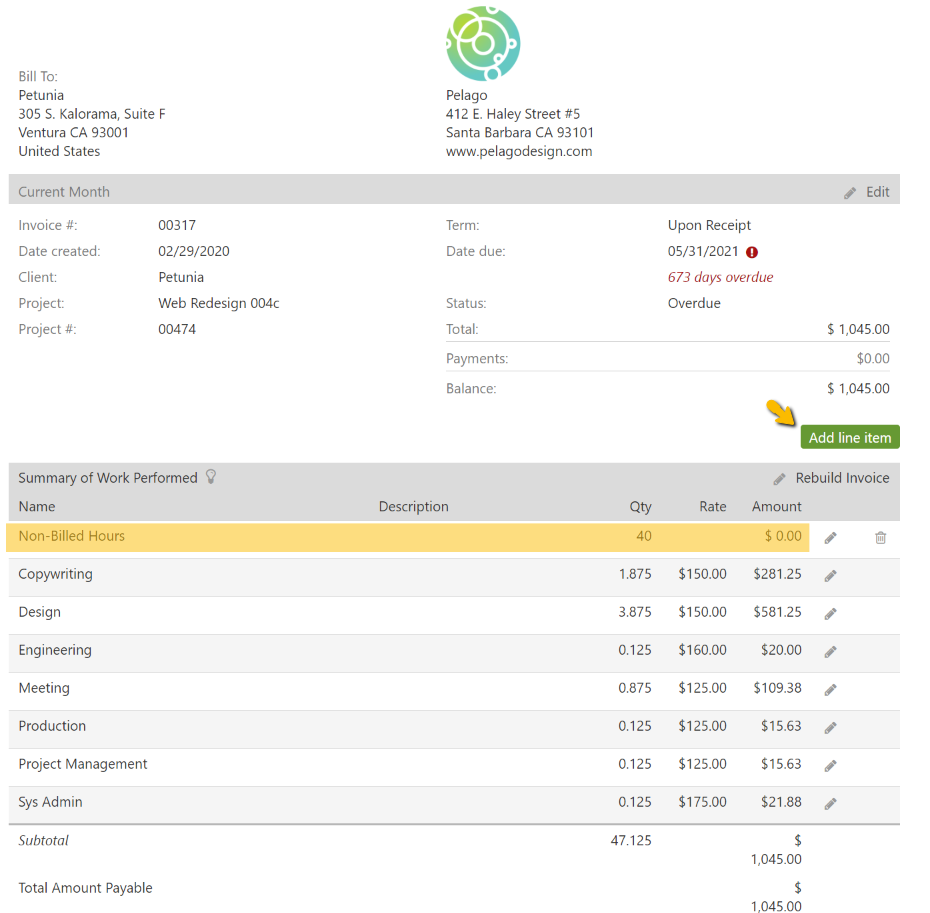

Add a line item for unbillable time

Once you’ve built the invoice you can add a line item to the Summary of Work section. Click the button to add a line item, then enter a description, the number of hours, and a rate of zero. Use the line item’s description to denote that the time is unbillable. And, with a rate of zero, it won’t affect the invoice total. This is the more simplistic of the two solutions and is most useful for showing a brief description and number of unbillable hours.

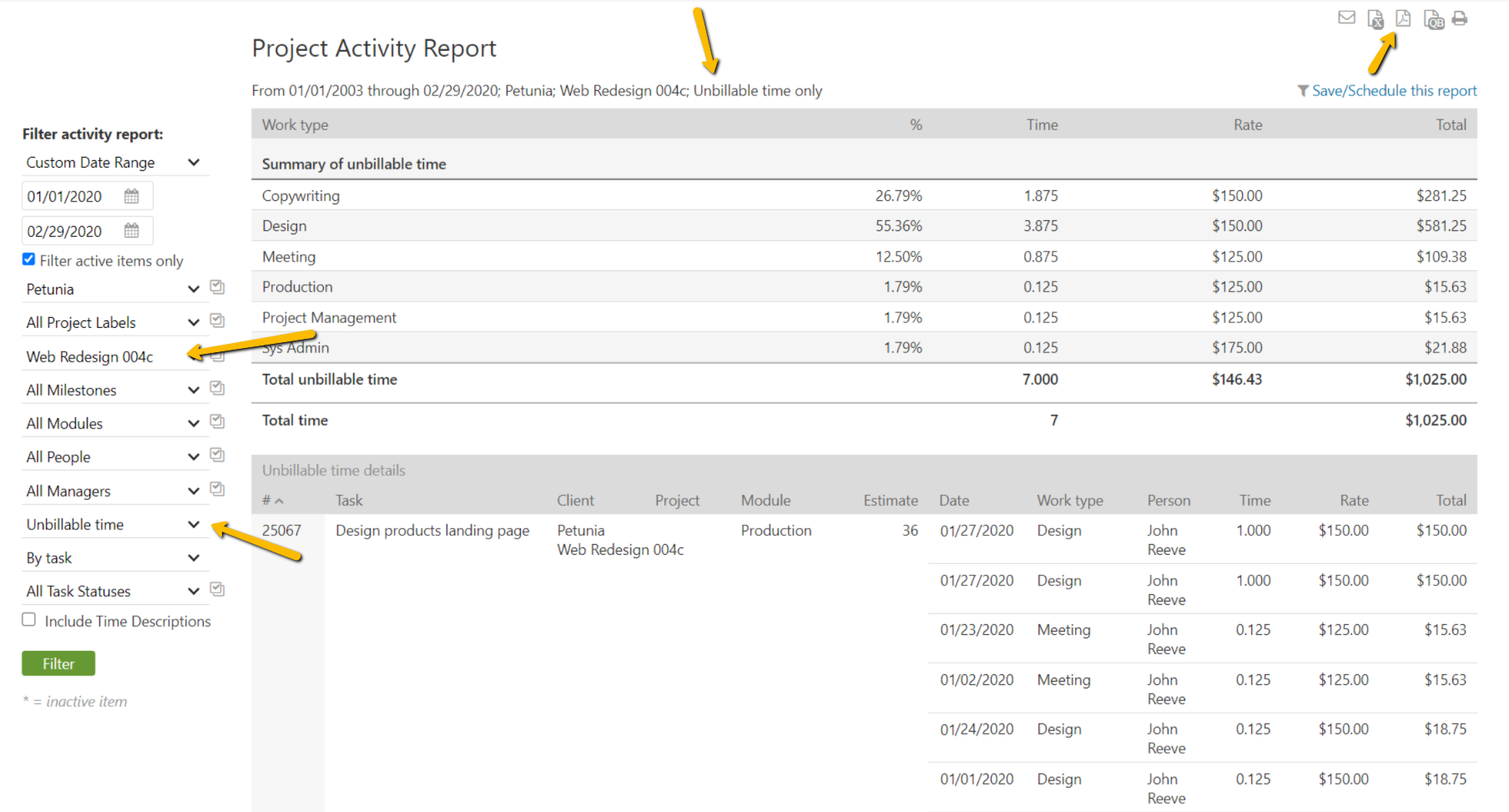

Include a report of unbillable time

A more advanced solution is to create a report outside of the invoice using the Project Activity report and send it along with the invoice. The project activity report has a similar format and details as an invoice. For example, it can be grouped by task to show exactly where that unbillable time was spent.

To generate a Project Activity report choose the same project and date range as your invoice, then select the unbillable time option in the left column. If you’d like to group the results by task, select that option as well. Then run the report and save as a PDF.